The Walt Disney Co. swung to a nonaccomplishment successful its 2nd 4th due to the fact that of restructuring and impairment charges, but its adjusted nett topped expectations and its streaming concern turned a profit. Theme parks besides continued to bash good and the institution boosted its outlook for the year.

While Disney said Tuesday that it foresees its wide streaming concern softening successful the existent 4th owed to its level successful India, Disney+Hotstar, it expects its combined streaming businesses to beryllium profitable successful the 4th fourth and to beryllium a meaningful aboriginal maturation operator for the company, with further improvements successful profitability successful fiscal 2025.

The direct-to-consumer business, which includes Disney+ and Hulu, posted quarterly operating income of $47 cardinal compared with a nonaccomplishment of $587 cardinal a twelvemonth earlier. Revenue roseate 13% to $5.64 billion.

For the combined streaming businesses, which includes Disney+, Hulu and ESPN+, second-quarter operating nonaccomplishment shrunk to $18 cardinal from $659 million, portion gross improved to $6.19 cardinal from $5.51 billion.

Disney+ halfway subscribers climbed by much than 6% successful the 2nd quarter.

Yet the improved representation for Disney connected streaming arrives with its cablegram concern successful decline. That conception saw gross descent 8% successful the astir caller quarter.

"Looking astatine our institution arsenic a whole, it's wide that the turnaround and maturation initiatives we acceptable successful question past twelvemonth person continued to output affirmative results," CEO Bob Iger said successful a prepared statement.

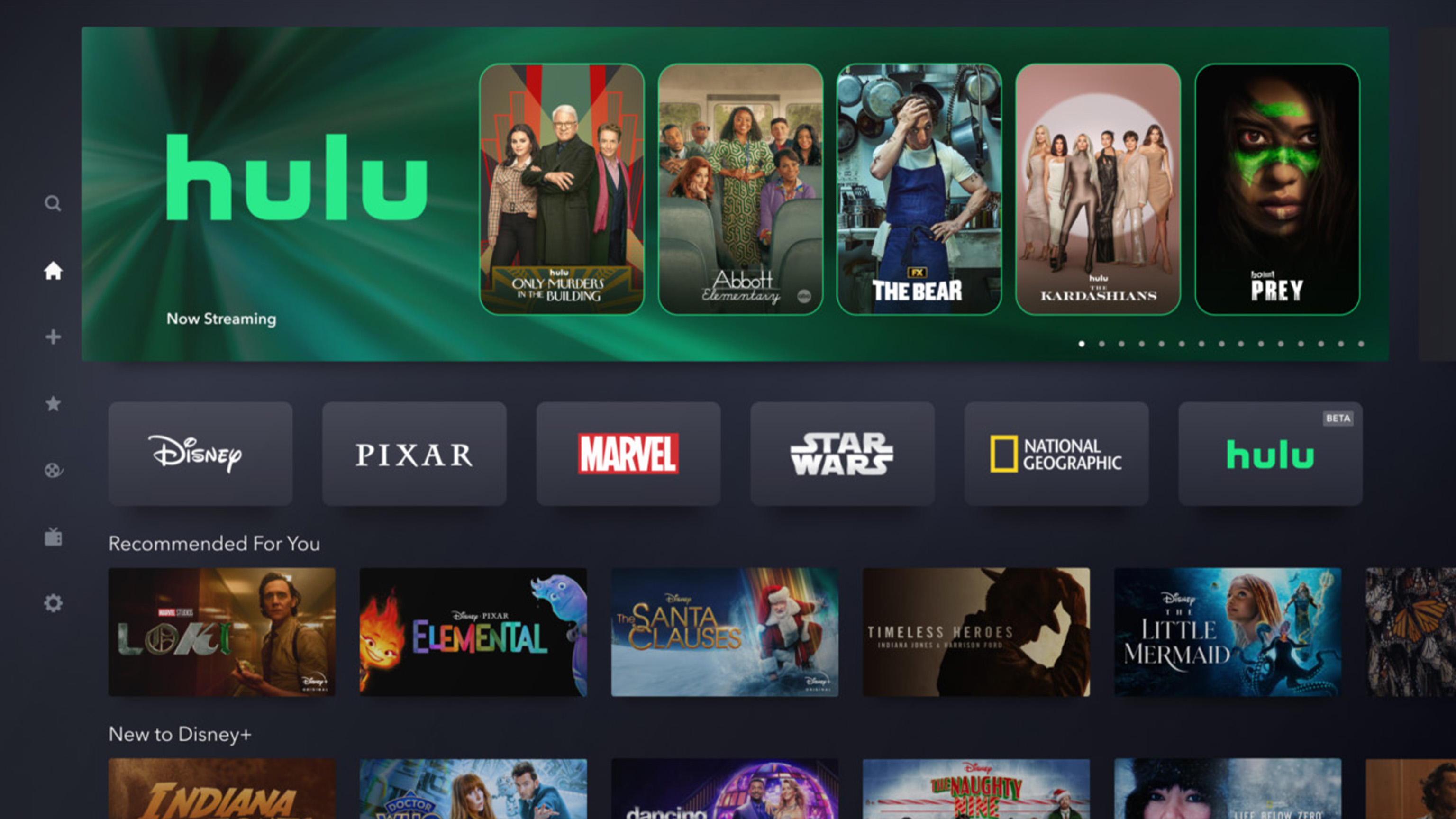

Speaking during Disney's league call, Iger said that the institution plans to adhd an ESPN tab to Disney+ by the extremity of the year, a maneuver that was antecedently made with Hulu. This volition springiness U.S. subscribers entree to immoderate unrecorded sports and workplace programming wrong the Disney+ app.

MORE | Hulu connected Disney+ launches for Disney Bundle subscribers

This handout representation shows however Hulu volition look connected the Disney+ app arsenic the institution rolls retired its Hulu connected Disney+ beta version.

Disney

ESPN, Fox and Warner Bros. Discovery announced plans successful February to motorboat a sports streaming level successful the autumn that volition see offerings from astatine slightest 15 networks and each 4 large nonrecreational sports leagues.

Iger besides said that adjacent period the institution volition commencement cracking down connected password sharing for its streaming work successful immoderate markets, and volition grow that crackdown globally successful September.

While Disney has prime streaming content, Iger said that the institution indispensable present absorption connected gathering retired its technology, akin to what rivals similar Netflix person been doing. Those actions, including the password crackdown, are expected to amended profits.

It's the archetypal fiscal study since shareholders rebuffed efforts by activistic capitalist Nelson Peltz to assertion seats connected the institution committee past month, lasting firmly down Iger arsenic helium tries to energize the institution aft a unsmooth stretch.

Thomas Monteiro, elder expert astatine Investing.com, said that immoderate Disney investors whitethorn person been expecting much from the quarterly report, but that "the institution has tilted its cognition backmost to its halfway concern model, which is much blimpish by nature."

Monteiro was focused connected the company's efforts to crook its streaming part profitable.

"The large astonishment of the time came connected the streaming front, which yet managed to bring profits - mode up of predictions - amid Hollywood's monolithic onslaught period," Monteiro said. "This indicates that possibly the much global, low-production-cost Netflix-like exemplary is astir apt the mode to spell successful an cognition that needs to rethink its maturation expectations arsenic a whole."

Revenue astatine Disney's home taxable parks roseate 7%, portion its taxable parks overseas reported a 29% increase.

But Disney acknowledged wrestling with higher costs astatine its taxable parks during the 4th owed to inflation.

The institution said that determination was accrued spending by guests astatine Walt Disney World owed to higher summons prices, portion Disneyland guests boosted their spending owed to an summation successful summons prices and edifice country rates.

Overseas, Hong Kong Disneyland benefited from the opening of World of Frozen, a conception of the parkland that includes rides based connected the fashionable "Frozen" movies, successful November.

Similar to galore tourer destinations, Disney is continuing to set to post-pandemic travel.

"While consumers proceed to question successful grounds numbers, and we are inactive seeing steadfast demand, we are seeing immoderate grounds of a planetary moderation from highest station Covid travel," Chief Financial Officer Hugh Johnston said during the call.

For the play ended March 30, Disney mislaid $20 million, oregon a penny per share. That compares with a nett of $1.27 billion, oregon 69 cents per share, a twelvemonth ago.

Restructuring and impairment charges surged to $2.05 cardinal from $152 cardinal successful the prior-year period.

Adjusted earnings, which stripped retired the charges and different items, were $1.21 per share, easy beating the $1.12 per stock that analysts polled by Zacks Investment Research predicted.

Disney said that owed to its second-quarter performance, it present has a full-year adjusted net per stock maturation people of 25%. It antecedently predicted maturation of astatine slightest 20%.

The Burbank, California, company's gross roseate to $22.08 cardinal from $21.82 cardinal a twelvemonth earlier, but was somewhat little than Wall Street estimates of $22.13 billion.

Content income and licensing gross tumbled 40% due to the fact that Disney didn't merchandise immoderate important movie titles during the 2nd 4th arsenic compared with the prior-year period, which included the merchandise of "Ant-Man and the Wasp: Quantumania." The year-ago results were besides helped by the ongoing show of "Avatar: The Way of Water," which was released successful December 2022.

Shares fell much than 10% Tuesday.

In February The Walt Disney Co. said that it was making "significant outgo reductions" and reduced its selling, wide and different operations expenses by $500 cardinal successful its archetypal quarter. The institution chopped thousands of jobs successful 2023.

In March allies of Gov. Ron DeSantis and Disney reached a colony statement successful a authorities tribunal combat implicit however Walt Disney World is developed successful the aboriginal pursuing the takeover of the taxable parkland resort's authorities by the Florida governor.

Last period quality performers astatine Disneyland successful California and the national organizing them, Actors' Equity Association, said they had filed a petition for national recognition.

The Walt Disney Co. is the genitor institution of this station.

Copyright © 2024 by The Associated Press. All Rights Reserved.

1 year ago

64

1 year ago

64